The pace of economic activity in the euro area will depend on the profile of the labor market.

Three starting points:

1 – Surveys suggest that businesses and households are rather pessimistic. The results are everywhere below the long-term average.

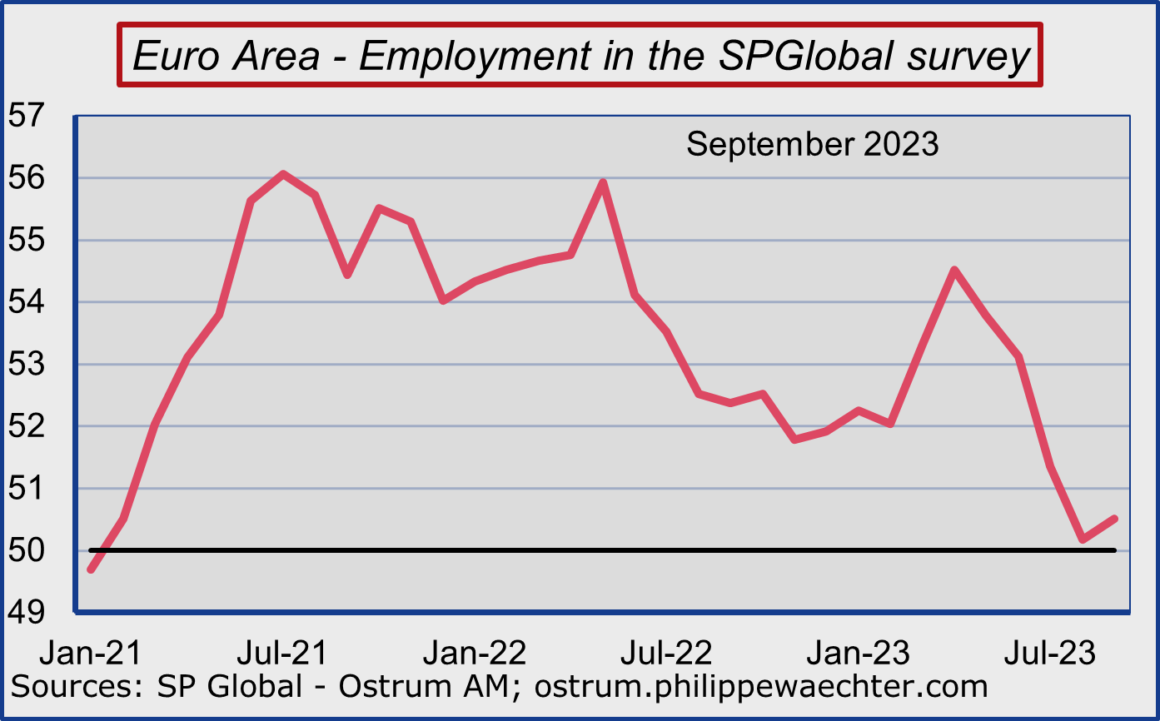

2 – Enterprises changed their attitude on the labor market in August (left graph). After creating a lot of jobs, they change their outlook.

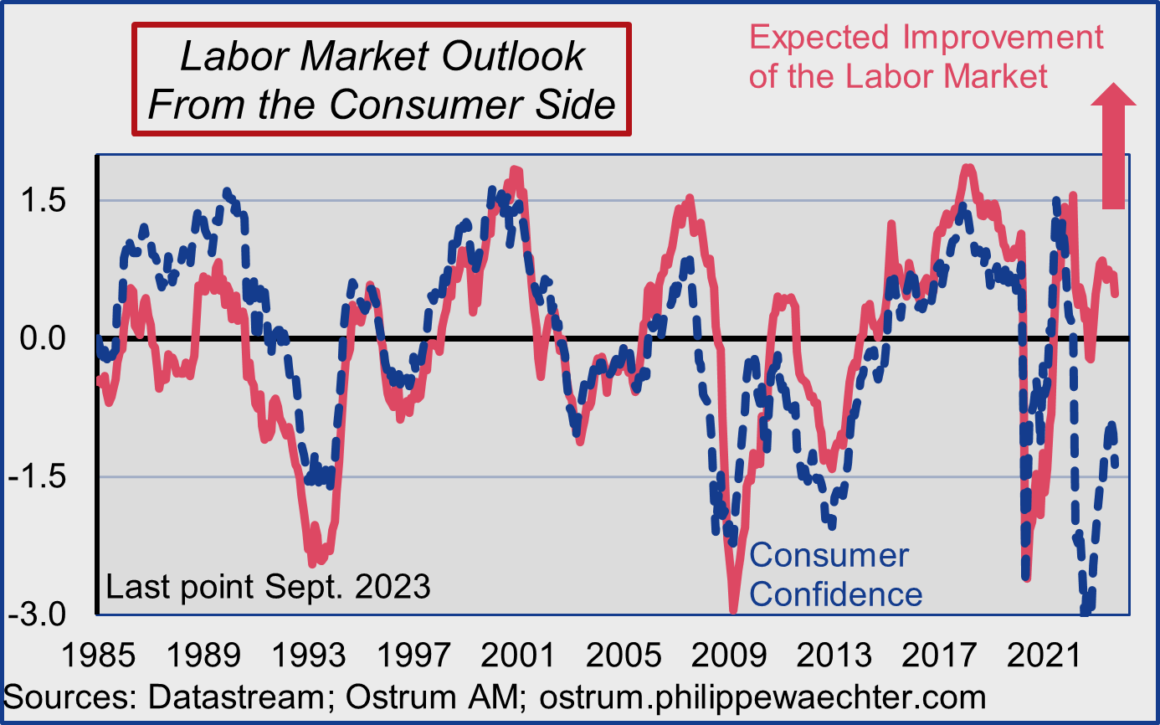

3 – Households are not optimistic (blue line at bottom).

Two points: historically, they are pessimistic when the labor market deteriorates. Currently, they are pessimistic while the labor market is buoyant and their perception is always positive.

What is the risk?

The ECB will not drop its guard quickly even if inflation slows down. Economic activity will not rebound spontaneously. As a result, the labor market equilibrium will change.

Recruitment difficulties will be reduced because companies will hire less. As a result, the bargaining power of employees will be lower.

This framework has two immediate consequences:

1 – No wage catch-up due to lower labor market pressures and slower inflation. Wage negotiations will result in a slowdown in wage increases.

2 – Households may become more worried about employment. This is not yet the case even if the indicator deteriorated in September (red Gr right). Spending could be penalized, making the consumer even more cautious. The fall in inflation would not be enough to reduce the constraints.

The risk is a lack of domestic demand momentum while governments want to save money and global trade is contracting. Growth is likely to be slow for some time to come.