Written with Aline Goupil-Raguénès

During today’s meeting, the probability is high that the Federal Reserve will decide to reduce the size of its balance sheet.

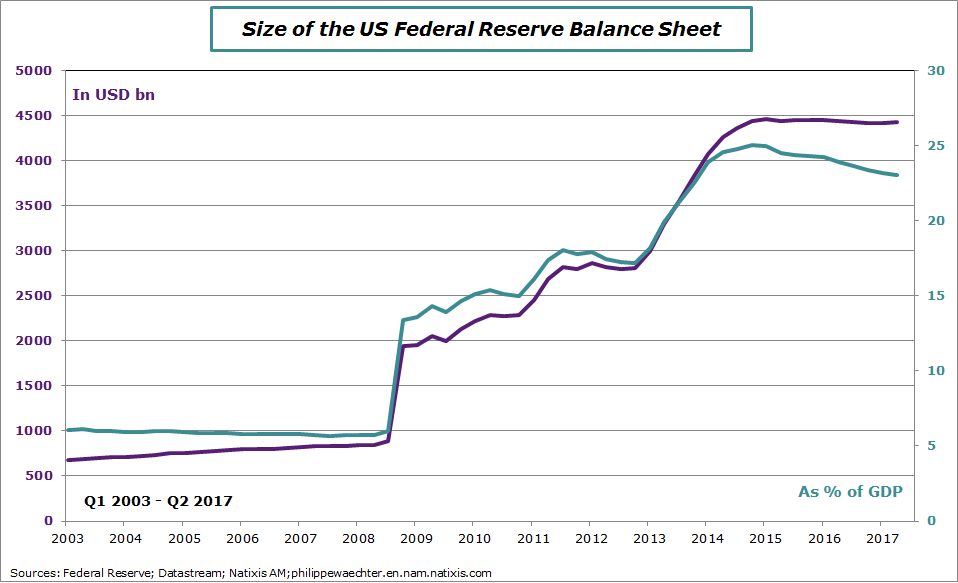

This latter started to increase at the end of 2008, first when the Fed was a provider of liquidity to the banking sector, and second when the US central bank started to purchase assets on a large scale. Few figures will give the scale of the transformation; in 2007 on average the size of the balance sheet was USD 830bn, it is now close to USD 4 500bn. As percentage of GDP the change is impressive from 5.7% on average in 2007 to 23% during the second quarter of this year.

Many questions are associated with this new step in the normalization of the US monetary policy. That’s the reason of this post and of the attached detailed document which is more technical but also more precise on the way it will work.

1 –Why normalize the Fed’s balance sheet?

The sharp rise in the Fed’s balance sheet results from the exceptional measures taken during the economic and financial crisis in order to make the monetary policy very accommodative and create the conditions for a recovery. It quickly dropped its key interest rates to bring the Fed funds rate back to [0; 0.25%], and as this was not enough, it bought massively Treasury bills and mortgage-backed securities (MBS). This resulted in a five-fold increase in its balance sheet (from $ 900 billion to $ 4 500 billion). Today, after eight years of recovery, the Fed considers that it is on the verge of achieving its two objectives: maximum employment and convergence of inflation to the target of 2% in the medium term. In this context, monetary policy should not remain so accommodative and should be gradually normalized. It started by gradually raising the Fed funds rate: 4 rate hikes since December 2015 to [1; 1.25%] in June 2017. It will now tackle its balance sheet. Its reduction will also allow the Fed to have additional margins of maneuver in the event of a shock on activity. It thus benefits from favorable economic conditions to gradually reduce it and to be in a better position to buy again financial assets if necessary. Especially since the probability of this happening is higher than before the crisis given the low level of the Fed funds rate. Lastly, starting to normalize the balance sheet now with a predetermined process allows to tie the hands of the future president of the Federal Reserve and to limit uncertainty in the markets.

2- When?

In June, Janet Yellen, the chair of the Fed, said it could begin “relatively soon” if the economy evolved as expected. This has been repeated since then. The Fed is likely to announce the reduction of its balance sheet at its meeting on 19 and 20 September and begin the process in October.

3- How?

Until now proceeds of the Fed’s portfolio were systematically reinvested in assets of the same quality.

Since September 2014, the Federal Reserve indicates that the reduction of the securities held would be in a gradual and predictable manner and mainly by ceasing to reinvest the repayments of maturing securities. It does not plan to sell assets at this stage. Once triggered, the reduction of the balance sheet will be done automatically and in the background of the adjustment of the main instrument of the central bank: the Fed funds rate. By acting prudently, the central bank aims to limit the risks of tensions in the bond market that could be generated by the reduction of the bonds held. This is indeed a form of monetary tightening with which it has little experience. This is why it is going to passively reduce the balance sheet in order to limit the impact on the markets. The fed funds rate will be the main instrument used in the conduct of its monetary policy. In June, it published details of its operating mode: reinvestments could be made only above a predetermined threshold. The latter will gradually increase over a period of one year to reach its maximum size and remain there until the balance sheet is normalized. For Bonds, the threshold is 6bn at the beginning. This level will increase by 6bn every three months during a year. Therefore at the end of the first year, the amount that will not be reinvested will be USD 30bn. For Agencies assets and RMBS, the mechanism is similar but with a threshold at 4 and a total at the end of 20.

However, the Fed is ready to increase its reinvestments again in the event of a marked deterioration in the economic outlook requiring a significant drop in the Fed funds rate.

4- Up to what level? Until when?

The central bank has not yet determined it. There are strong reasons to believe that its size will remain well above the level that prevailed at the beginning of 2008 and this for two reasons that are on the liabilities side of its balance sheet. Demand for money is higher and the level of reserves is expected to be much higher than before the crisis (stronger demand for safe assets from financial institutions and the way the Fed will pilot the Fed funds rate). The Fed said the amount of reserves would be significantly below the level seen in recent years but more important than the pre-crisis one. According to the latest estimates of the Federal Reserve Bank of New York, the balance sheet could be normalized between 2020 and 2023 and the amount of securities held would then be reduced from $ 1 to $ 2 trillion, depending on the assumptions made on the amount of reserves. This compares with a $ 3.7 trillion increase in securities held by the Fed between the end of 2008 and the end of 2014. The balance sheet would thus remain at a high level (between 10 and 16% of GDP) and then increase again thereafter due to the rise in demand for money and reserves.

5- Consequences?

The Federal Reserve is confident in its ability to reduce the size of its balance sheet without generating strong tensions in the bond markets. The estimates made by its teams show a limited impact on rates. The reason is that it clearly communicated its intentions and method of operation well before the start of the reduction in the balance sheet. The objective has been to prepare well investors to this change and not to take them by surprise. The central bank wants to avoid the turbulence that shook the bond markets in 2013, when Ben Bernanke, the chair of the Fed, had evoked an upcoming reduction in asset purchases. However, given the colossal size of its balance sheet and the lack of experience in this area, it’s not possible to exclude a stronger reaction from markets than that anticipated. In this case, the Fed will integrate it into its monetary policy decisions. It could thus be led to realize less than expected increases in the Fed funds rate, or even reduce it in the event of excessive tensions. This is the reason why it waited until the rate hike was well under way before normalizing its balance sheet, so as to be able to reduce them in the event of a tightening of financial conditions. Margins of maneuver are however reduced and for this reason the Federal Reserve is ready to increase reinvestments in the event of deterioration of economic prospects requiring a sharp drop in the Fed funds rate. It is also ready to change the size and composition of its balance sheet if economic conditions require a monetary policy even more accommodative than that allowed by the decline in the Fed funds rate.

Philippe Waechter's blog My french blog