13 points this week to follow the macroeconomic momentum.

1 – The Fed is back in the game after its last week meeting (27/28 October). It hasn’t changed the stance of its monetary policy but it has deeply changed its press release. Headwinds coming from the external environment of the US economy were the main point to notice in September. The message from the Fed was that the probability of a Fed’s lift-off this year was low. This point has been erased in the October’s press release. Moreover, the Fed has mentioned explicitly a potential change at its next meeting (15/16 December).

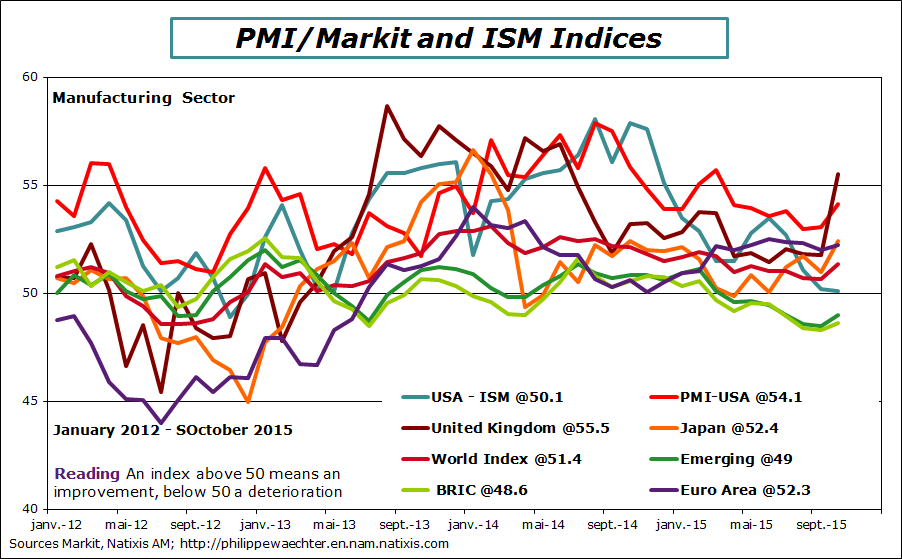

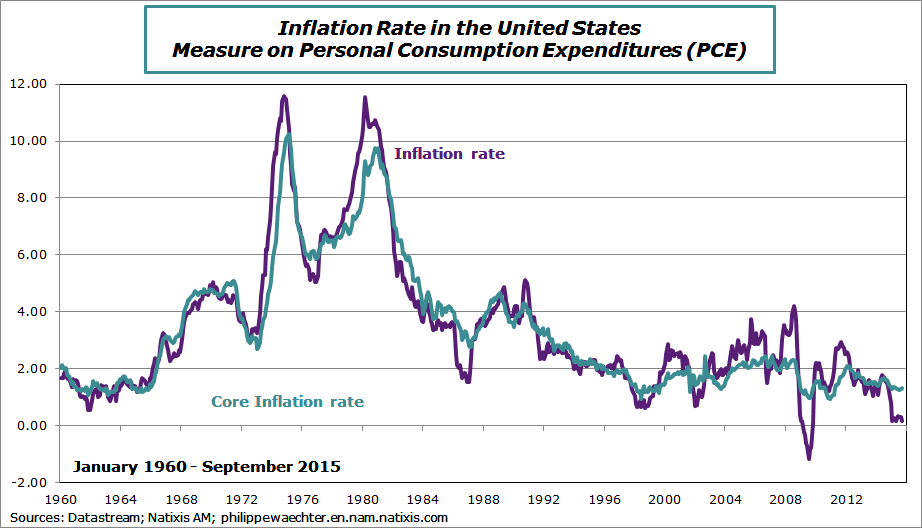

Can we expect a lift-off in December? I don’t think so. The main reason for a change would come from the US central bank commitment to hike its interest rates in 2015. But as always the decision will be data dependent. The current economic situation will not create tensions that could push the Fed to change its strategy very rapidly. Recent data on the ISM and on retail sales have shown weakness that cannot be a support for a change.

Janet Yellen will testify in the Congress at the beginning of December (2 and 3). It could be a source of information on the Fed’s strategy

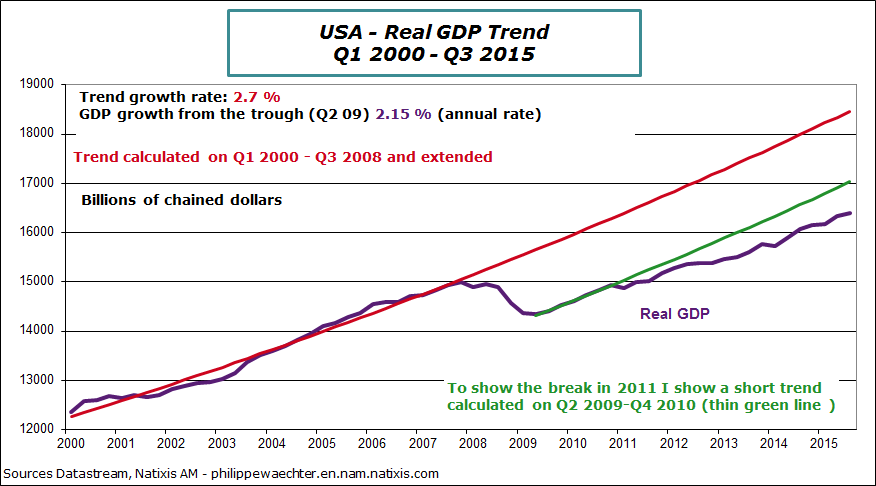

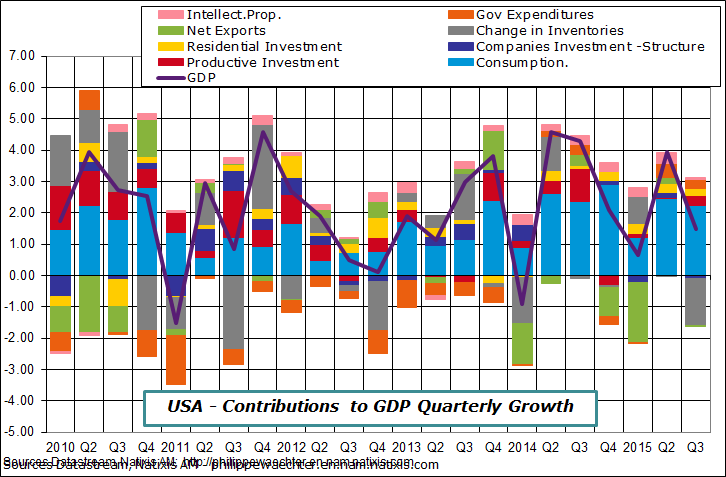

2 – GDP growth for the third quarter was nevertheless robust. GDP has increased by 1.5% at annual rate after 3.9% during the second quarter. The carry over growth for 2015 at the end of the third quarter is 2.3%.

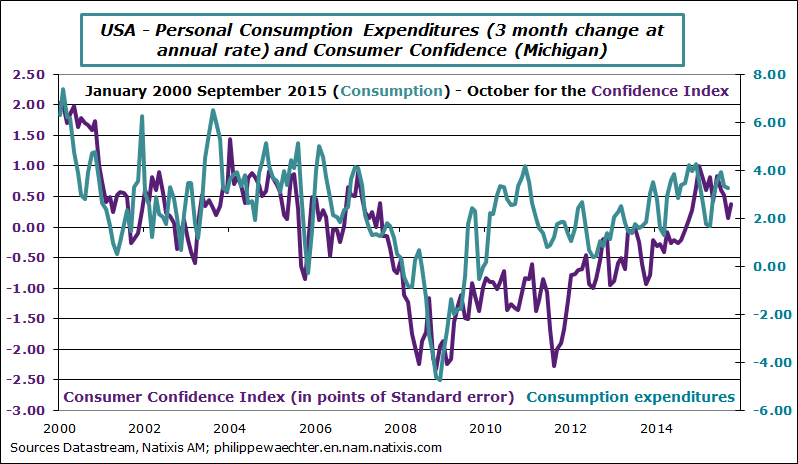

We notice that consumption is still very strong and that productive investment is supportive for growth. Net exports have a marginally negative contribution.

For 2015, we can expect a GDP growth in the range 2.4 to 2.5%.

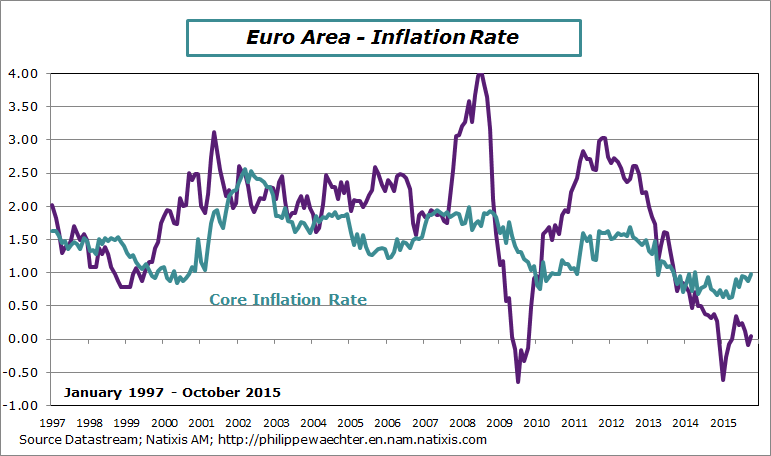

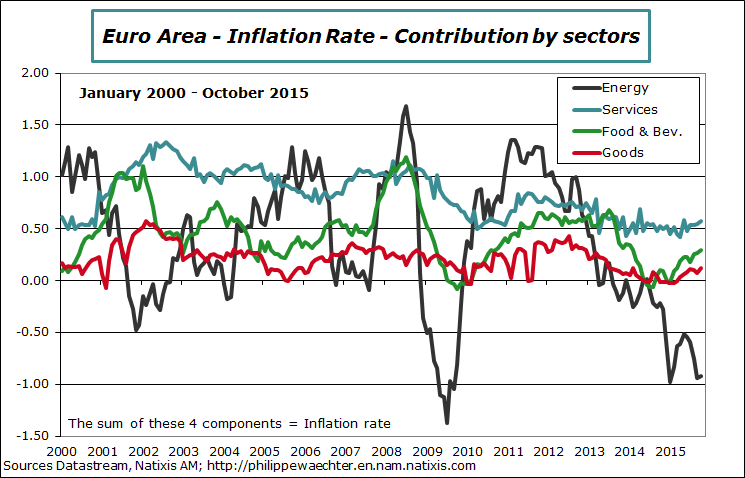

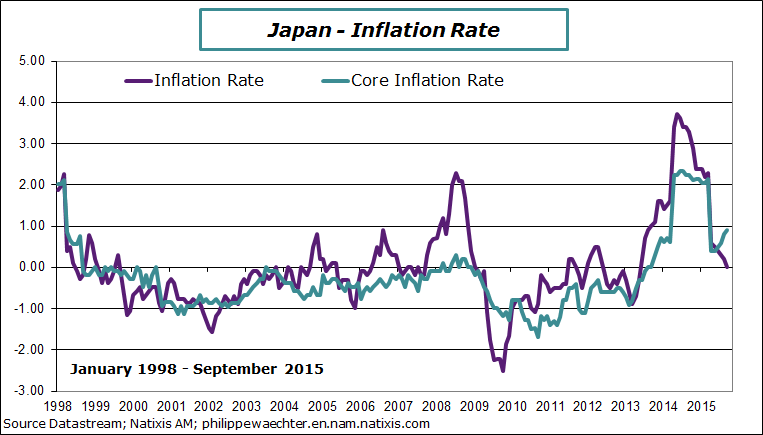

6 – The Eurozone inflation rate was at 0 in October after -0.1% in September. The carry over for 2015 at the end of October is 0% This is not good news for wage indexation.

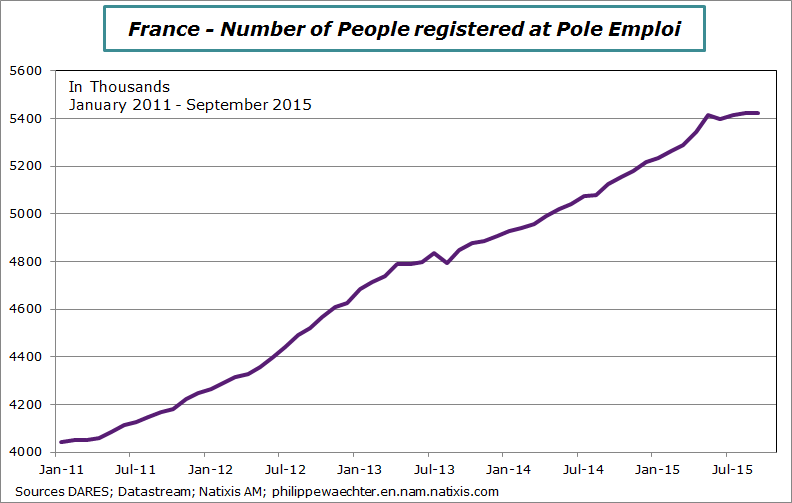

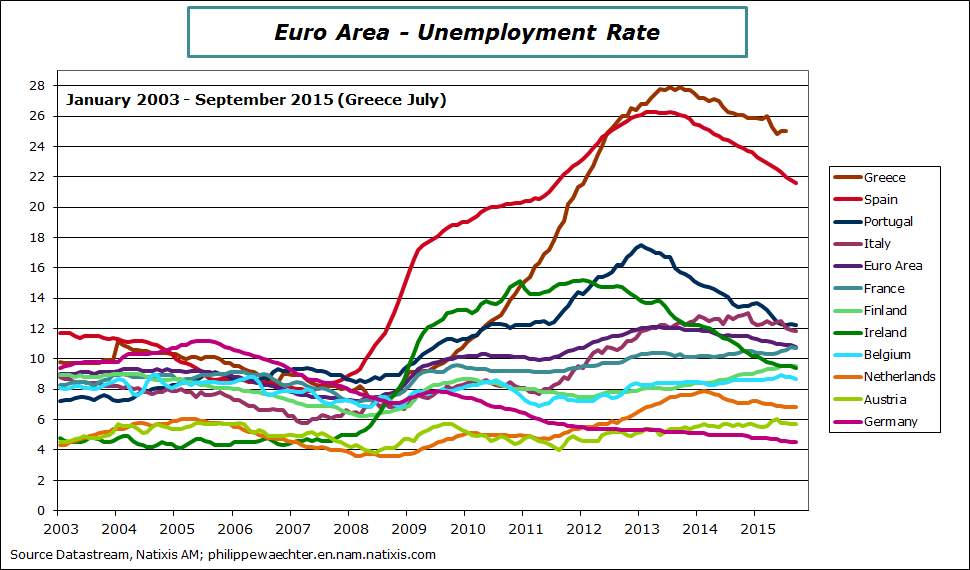

For the main countries, only three see an increase of the unemployment rate when it is compared to September 2014: For Finland it is up by 0.6%, for France by 0.3% and for Belgium by 0.1%.

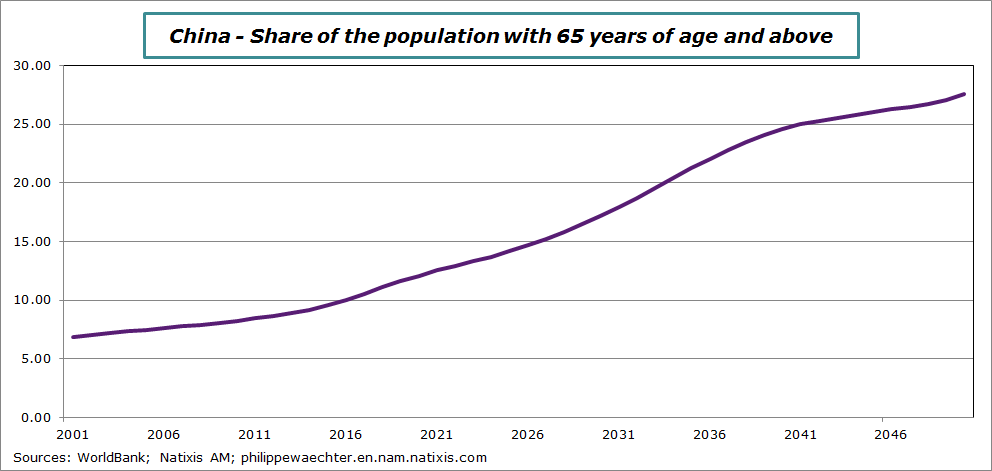

The One Child Policy has been relaxed in 2013. It was possible after the change to have a second child if either parents is an only child. The impact was an extra 1 million births which is not huge at the Chinese scale.

The expansion of the Chinese population reflects aging population. For the last twenty years, the fertility rate was below the level that could maintain the population size but this population has increased by 200 million. It is just the characteristic of an ageing population. This trend will not change rapidly; simulations made by the WorldBank suggest that the share of the population for people above 65 years of age will increase from 8% in 2010 to 27% in 2050. This is the real issue.

From Asian examples on demography we notice that it is easier to constraint behavior with anti-natalist policies than to expect a boom after such policies. These policies have a strong and persistent effect.

This will be a support for the GDP growth number for the third quarter.

A brighter outlook for the Eurozone and for France will help to push down this indicator. This will reflect a more dynamic labor market. In France, this statistic is followed by François Hollande whose economic policy commitment is to drive down this indicator.

For the week to come, one major point will be the Markit and ISM surveys : Monday for the manufacturing sector and Wednesday for the non manufacturing. (The graph below shows the indices in October)

The other major point will be the US employment report (Friday). Depending on its profile it may have an important impact on monetary policy decisions.

On Thursday the meeting of the Bank of England is not expected to create surprise. The inflation rate at 0% is not an incentive to lift-off interest rates.

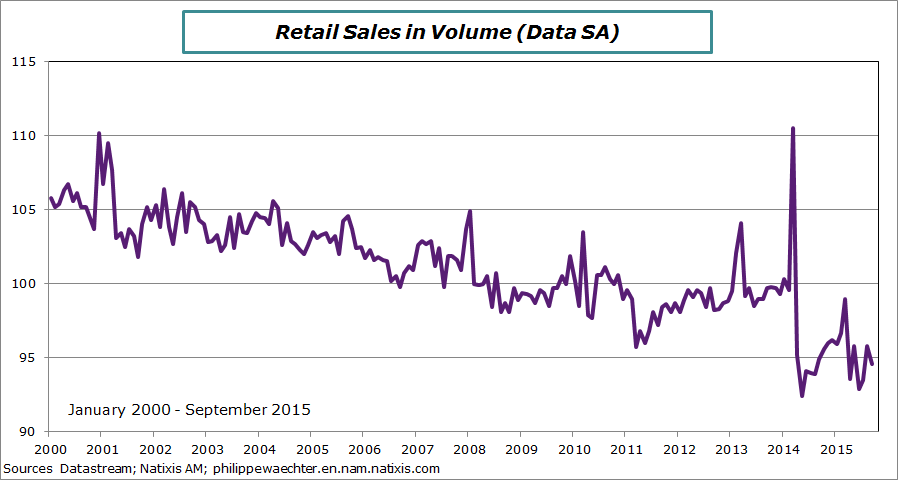

In the Euro Area, retail sales (Thursday) for September will give a more precise idea of households’ expenditures for the third quarter and a good source to scale GDP growth.

We will also have orders to the German industry on Thursday. The important issue here is what will be seen in the sub-sector of capital goods for the Euro Area. A rapid improvement since last spring could reflect a stronger investment dynamic.

On Friday, industrial production indices for Germany and the United Kingdom will be available. It will help to forecast German GDP for the third quarter

Good week to everyone

Philippe Waechter's blog My french blog