Currently, the most important graph is the price of oil.

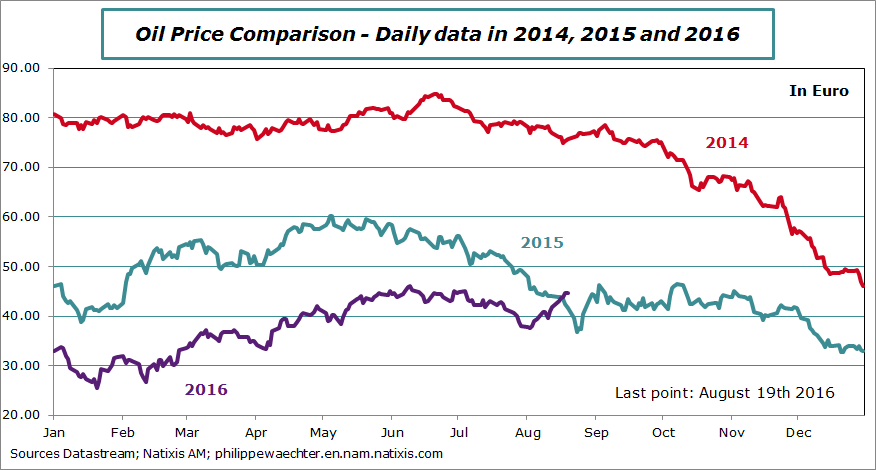

Last week, the oil price was above its level of August 2015. The oil price has started to fall at mid-2014. Since this moment, the oil price was always below the level it had one year before. this has changed last week. It’s the first time since 2014 that we see such a crossing.

This means that the energy contribution to the inflation rate will rapidly tend to 0 and if the price remains close to 50 the contribution will become positive. Therefore the inflation will rapidly converge to the core inflation rate. It will still be below central banks’ target (2%) but it is an important step.

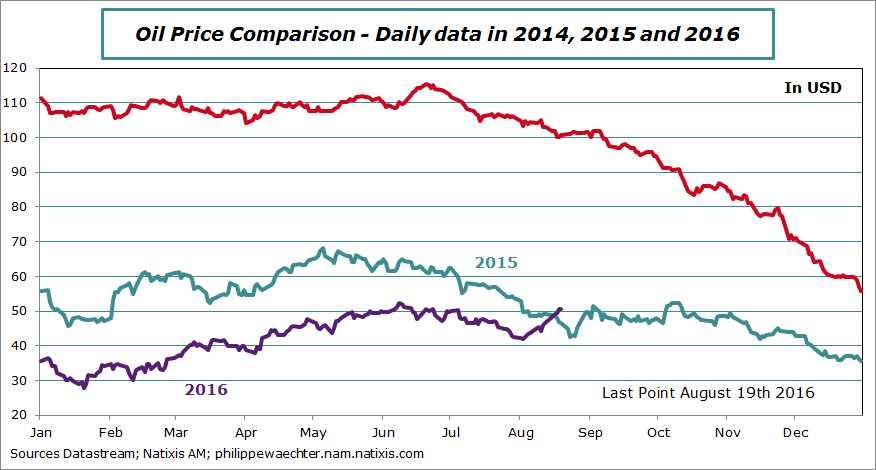

We see on the graph below that the price in 2015 was always below 2014. It was also the case for 2016 until last week. (the graph is the same in US dollar see at the bottom of this post)

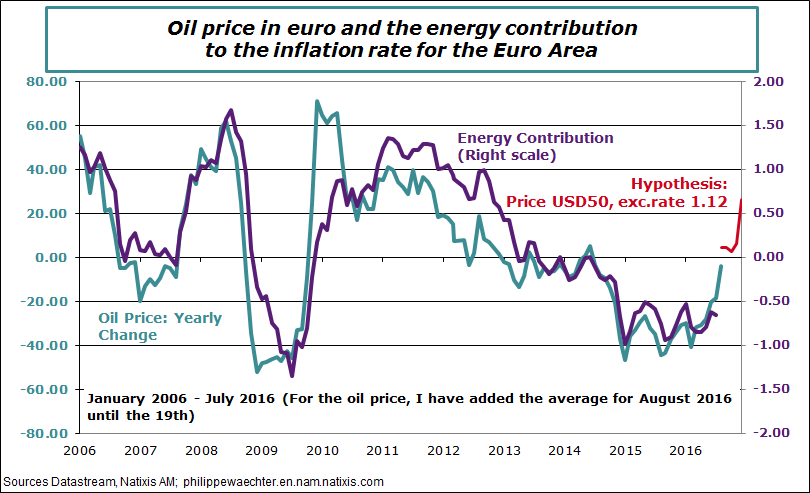

The graph below compares the yearly change in oil price (in euro) and the energy contribution to the inflation rate in the Euro Area. The two series have consistent profiles. For August 2016 the oil price is the average until 19. The red curve is the oil price yearly change if, every month, the oil price is USD50 and the euro dollar exchange rate is 1.12.

Under these hypothesis, at the end of the year the red curve could be consistent with a energy contribution to the inflation rate close to 0.5%. If we add it to 0.9% (July core inflation rate), then the inflation rate could converge to 1.4% in December.

Annex

Philippe Waechter's blog My french blog