Christine Lagarde at the European Parliament on December the 2nd. Markit and ISM surveys, German industrial orders, the Chinese external trade and US employment. The COP 25 in Spain.

Highlights

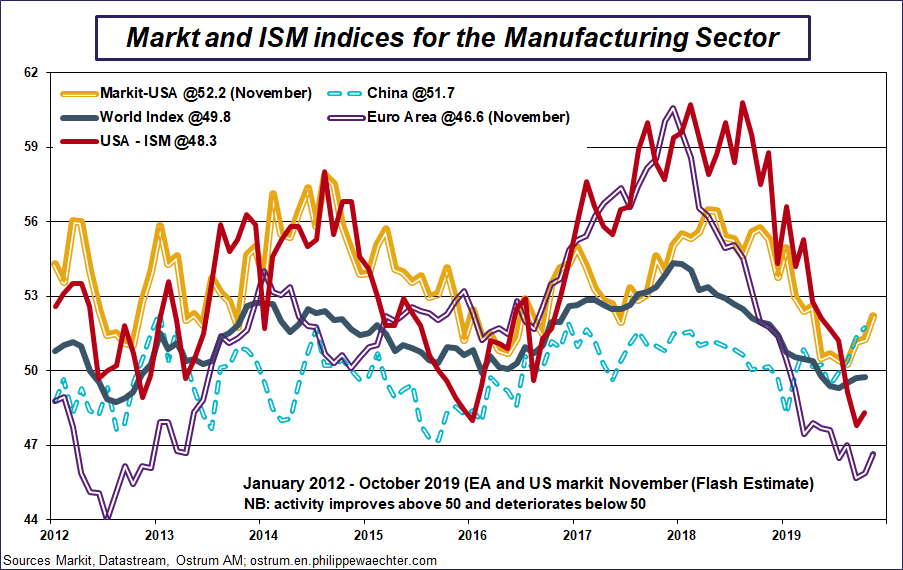

> The short term dynamics will be highlighted by the release of the worldwide Markit survey on the manufacturing sector (Dec 2)

In the November flash estimate of these survey for the US and the Euro Area, indices improved. The US remains above the 50 threshold (52.2 in November) while the Eurozone jumped at 46.6 after 45.9 in October. Japan also stabilized at 48.6. The good news is the official Chinese PMI which was above the 50 level, at 50.2, for the first time since last April.

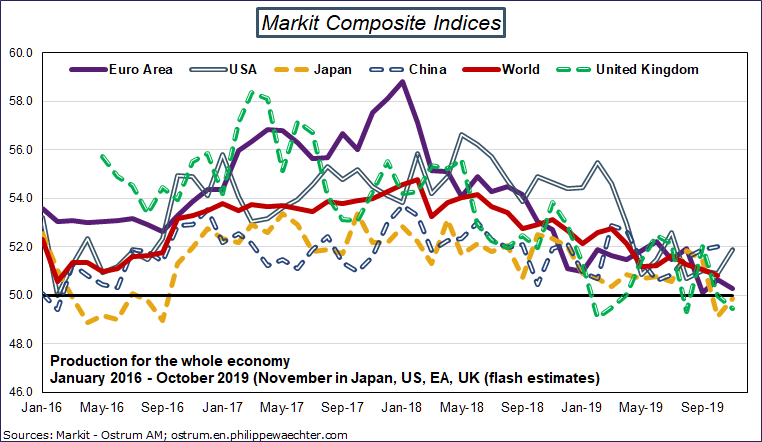

> On December 4, Markit will release the services survey indices and the composite indices and ISM the non manufacturing index for the US

In recent months, services indices had a lower momentum. This reflects the impact, with delays, of the lower dynamics in the manufacturing sector. The flash estimates have shown that, except in the US, the picture was weaker than in recent months.

The important point on this question will be the ISM survey. The ISM global index (a weighted average of the manufacturing and non manufacturing indices) was on a slower trend that will reflect in lower growth numbers in a foreseeable future.

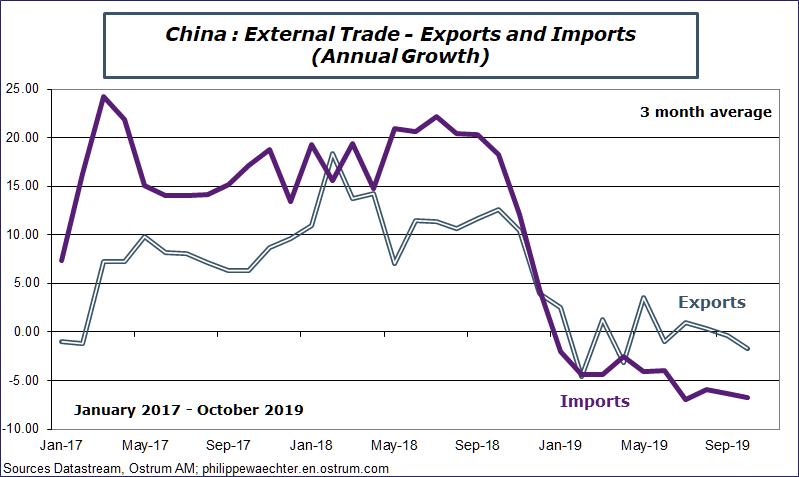

> External trade in China for November (Dec 8)

The main question for China is the profile of its exports. In recent months it was close to zero before plunging way below 0 in October. A negative figure may have a strong impact on the trade agreement negotiations with the US. A first round may be signed in coming weeks depending on the current data on trade.

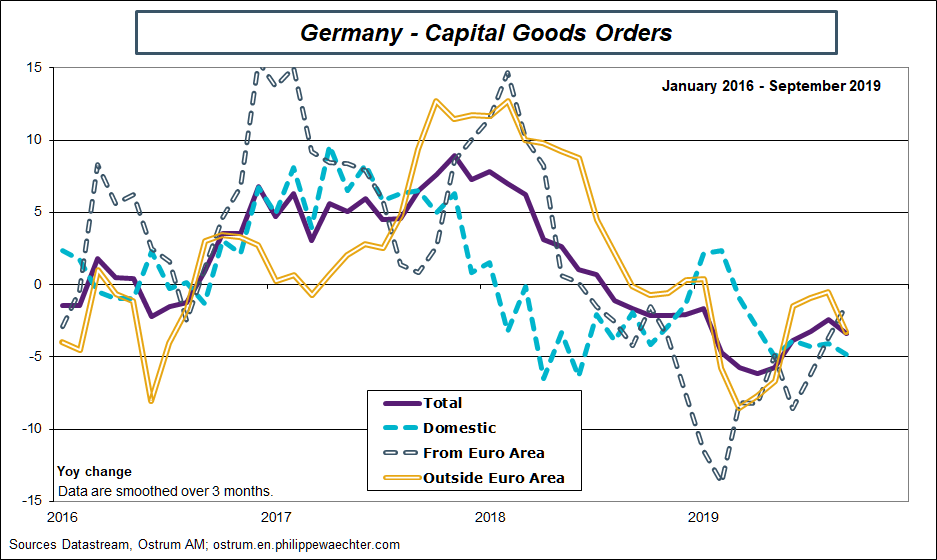

> The German industrial momentum is conditioned by the flows of orders (Dec 5).

The real question in Europe is the possibility of a recession in Germany. Recent GDP growth data have not been convincing that the German economy will avoid a recession. Nevertheless, corporate surveys stabilized in October and November. The trough may be nigh.

The industrial orders data will highlight the possibility of a rebound (The German industrial production for October will also give many information on this specific point (Dec 6)).

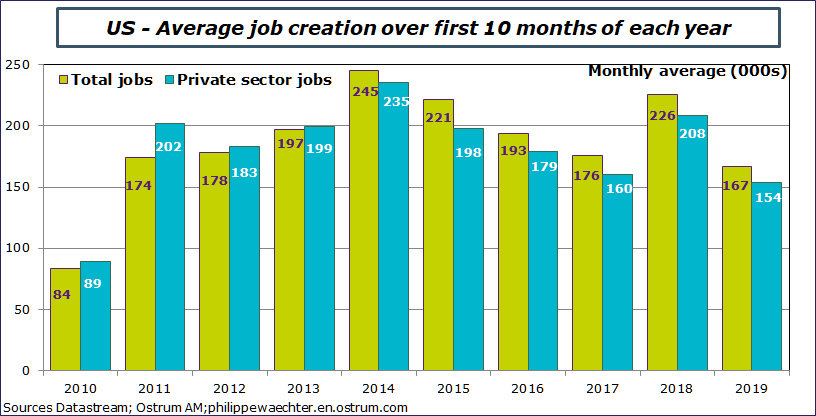

> US employment for November (Dec 6)

The jobs creation momentum remains strong. The figure in November will be robust but no spike is expected on wages and the unemployment rate will remain close to the current 3.6%.

> From December 2 to December 13, the COP25 will take place in Spain.

Spain replaces Chile after the recent social unrest in Santiago. But we have to remember that Chile was itself replacing Brazil which didn’t want to be committed on environmental questions after Bolsonaro’s election.

The climate change issue is often a kind of adjustment variable at the global level showing that the question remains secondary for many governments.

We have to keep in mind that in many countries where governments do not want to commit on environmental issues, the divergence with the population is, in many cases, larger and larger every day. It may be a source of unrest in a foreseeable future.

This document is available to download