The document in pdf is here Economic Weekly-NatixisAM-04-06-2015

Many things to look at this week

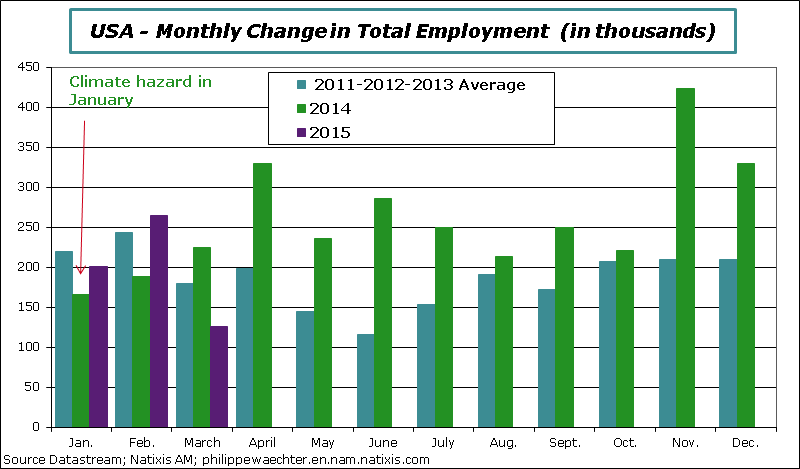

The first point to be mentioned is the lower momentum on US employment. In March, the number of new jobs was low at 126 000 versus 264 000 in February. January and February figures have been revised downward by -69 000. In a recent past, revisions were on the upside.

During the first quarter, less than 200 000 jobs were created each month on average (197 000 exactly) versus 324 000 for each month on average during the last quarter of 2014. The biggest change can be seen in “professional and Business Services” where the number of new jobs has been divided by a factor 2 between the last quarter of 2014 and the first of this year. In the manufacturing sector, 29 000 new jobs were created on average in the last three months of 2014. The number was just 6 000 on average for the first quarter.

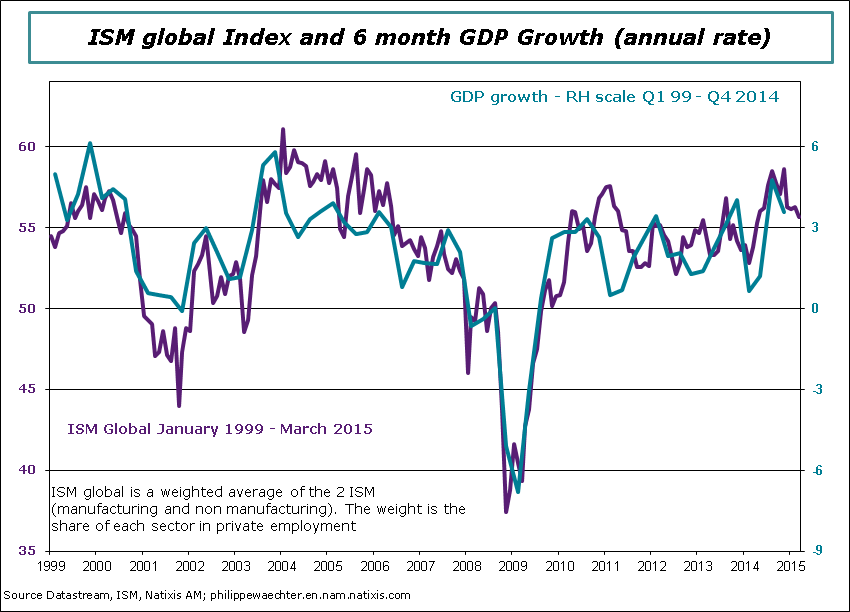

The 2 ISM surveys have a poor dynamics that is consistent with these numbers. The manufacturing index was down to 51.5 in March and the quarterly average was just at 52.6 versus 56.9 during the last 3 months of 2014. Weaker new orders are the main explanation of this weakness. The non-manufacturing index was at 56.5 in March and its first quarter average was at 56.7 versus 57.4 in the fourth quarter of 2014.

The global ISM index which is a weighted average of the two synthetic indices was at 55.7 in March versus 56.2 in February. The first quarter average is 56; it was 57.3 in the last quarter of 2014. There is no drama in these figures but they show that the American economy is losing steam.

The climate hazard is not the main explanation. In the labor report from the Bureau of Labor Statistics, the number of people whose job was constrained by a climate hazard was not particularly high. This is not the main explanation. Of course it was cold and very cold in the North-East but it wasn’t the case in the West.

The main question is to know if the weakness of the first quarter is temporary with a robust recovery in spring of if it is a change in trend with persistent weakness in the dynamics. We cannot exclude that growth numbers will be milder in the coming quarters.

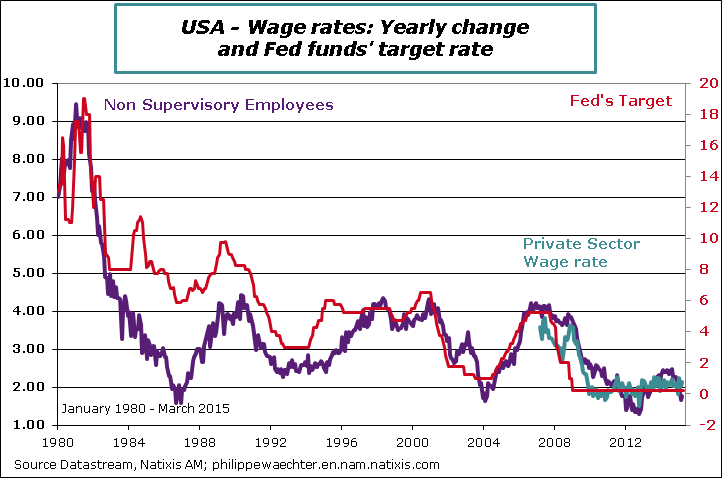

The chart, below, shows the fed funds’ target rate and the annual change in wage rates. Both indicators catch the business cycle of the US economy. The current momentum doesn’t seem to be robust enough to imagine a durable change in the fed funds’ target.

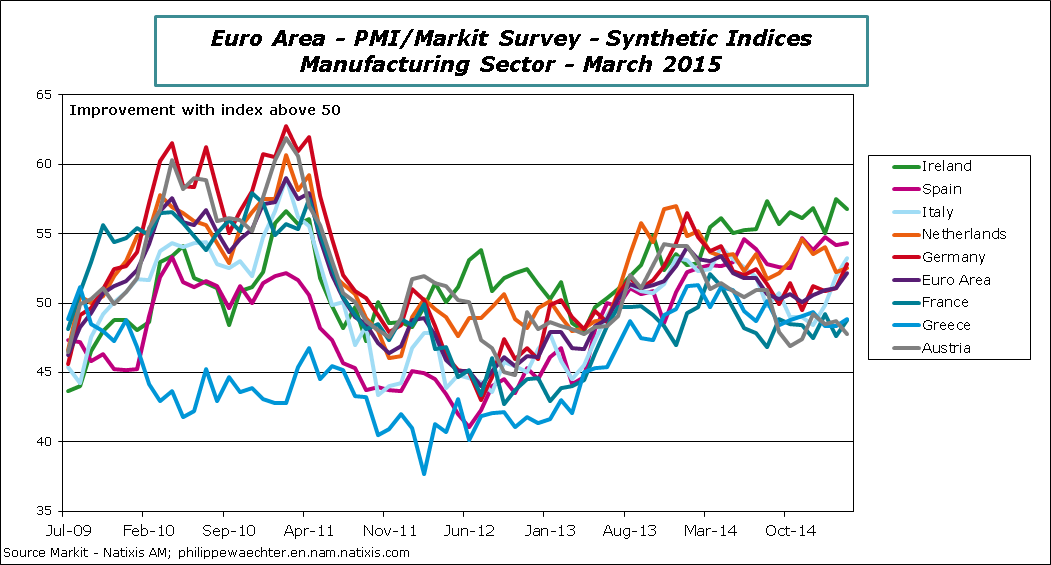

For the Euro Area the new orders momentum is strong and will create a rapid growth in industrial production in the coming months.

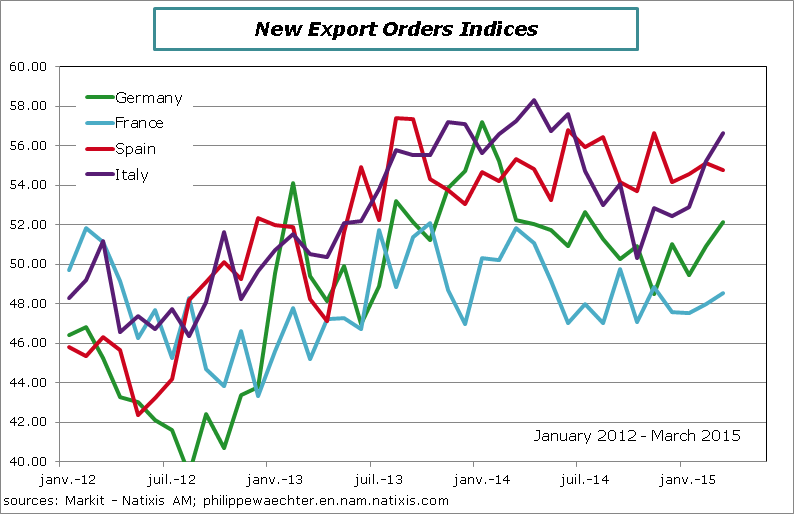

The main difference between France and its main trade partners relies on the fact that Spain, Italy and Germany are able to catch export orders. This is not the case for France. As it is shown on the graph, indices for export orders are above 50 in Italy, Spain and Germany. The interesting point is the rapid rebound in Italy. It’s probably the result of the lower euro (France and Italy have a problem with price competitiveness). Italy has taken advantage of it, not France. In the ECB’s strategy the lower currency is a large part of the success. If France cannot catch it, it is problematic.

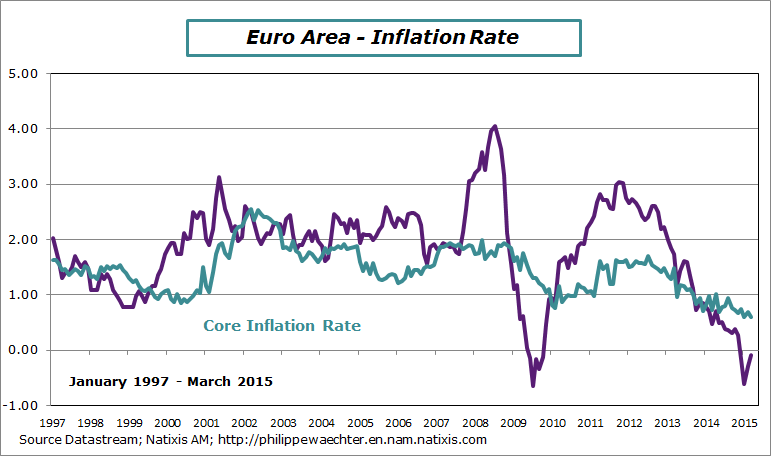

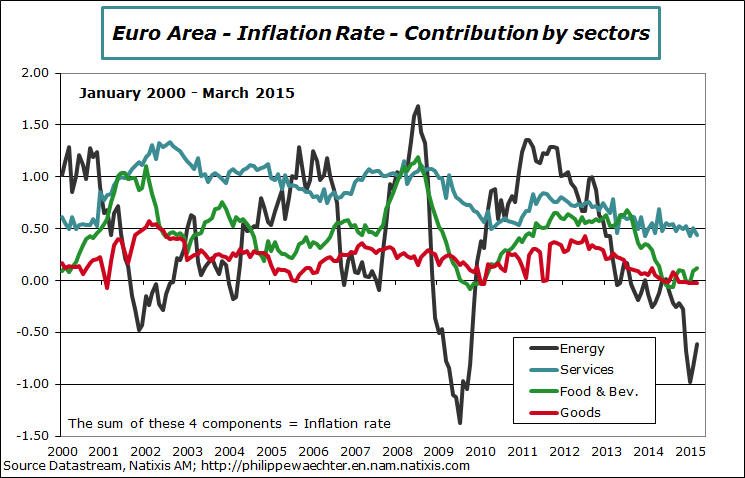

The inflation rate is at -0.1% in March after -0.3% in February. It reflects mainly a lower contribution from energy which was at -0.6% in March versus -0.8% in February. Nevertheless, the core inflation rate is trending downward at 0.6%. Pressures on prices are limited and the ECB has to keep its strategy on the top of its agenda

For the coming week, the most important figure will be retail sales in the Euro Area. Since the last quarter of 2014, sales are on the upside and are a first signal of recovery. (February number on Wednesday)

In Germany, industrial orders for February will be important (Wednesday). The industrial production index will be published for Germany on Thursday and for France and UK on Friday.

Minutes from the last FOMC meeting will be published on Wednesday and the monetary committee of the Bank of England will meet on Thursday.

On Thursday also, inflation rate in China will give signal on the risk of deflation