Published in French on October the 26th – Data expected this week but already published are briefly discussed.

8 points to keep in mind this week to highlight the macroeconomic momentum

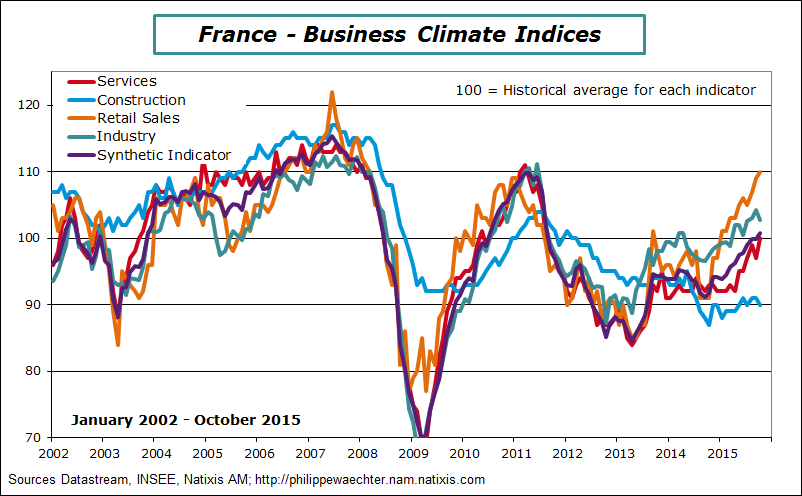

1 – The improvement of the French economy is the real good news

The business climate index, published by INSEE the French Statistical Institute, is above its historical average for the first time since August 2011.

It shows how deep and persistent was the negative shock that has hit the French economy since this period. Looking at the different sectors, building construction is the only one being still on the weak side. Services, Industry and retail trade contribute positively to growth.

This new momentum associated with a trajectory of low oil price and low-interest rates for long will help the French economy to converge to a more robust and attractive profile.

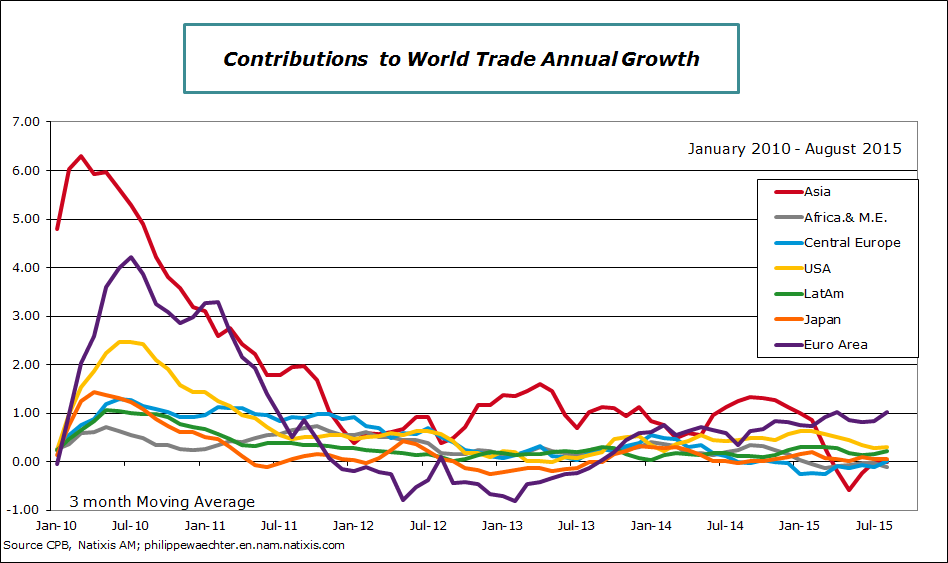

Moreover incentives to invest in France and in Europe are stronger because emerging economies follow a low growth trajectory.

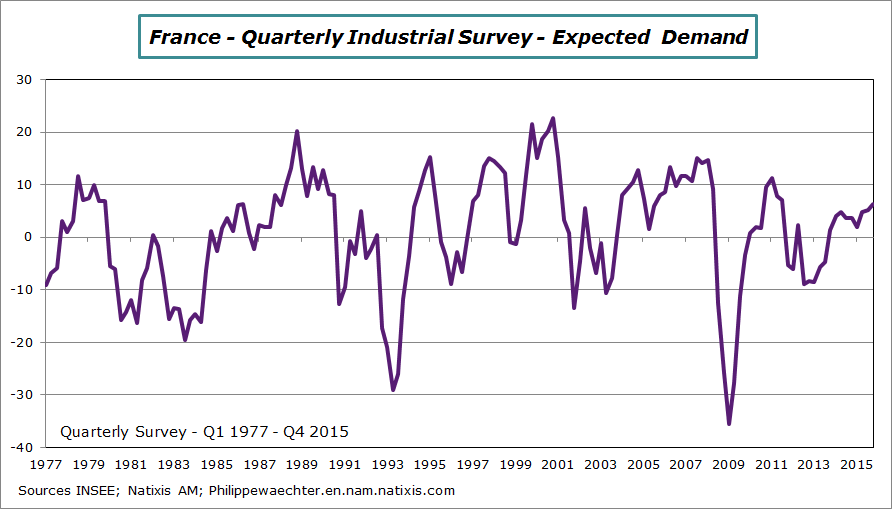

New orders and employment indices are robust in October. But the synthetic index is supported by the service index which is higher in October (53.2 vs 52.6 in September) whereas the manufacturing index remained at the same level that in September (52).

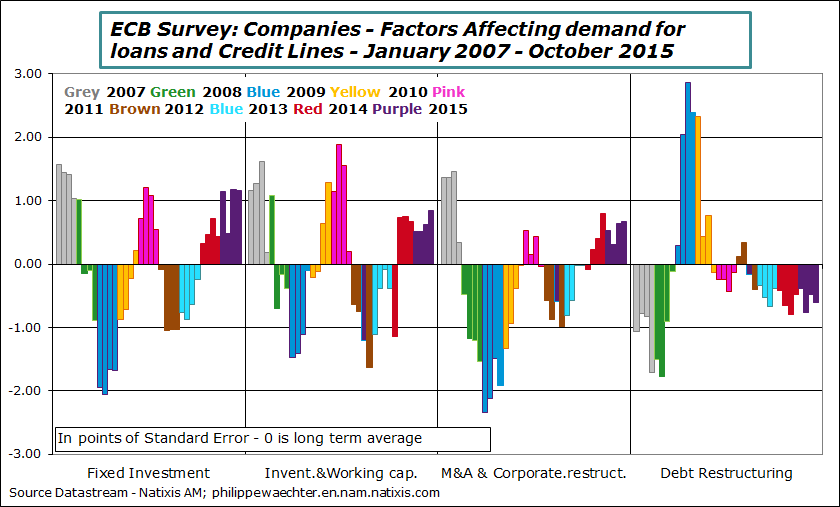

We can notice on the chart that the companies’ demand for credits is focused on investment and on inventories and working capital. These two items are improving rapidly. It shows short-term momentum is stronger and that companies are ready for stronger commitments in the future. That’s a good combination.

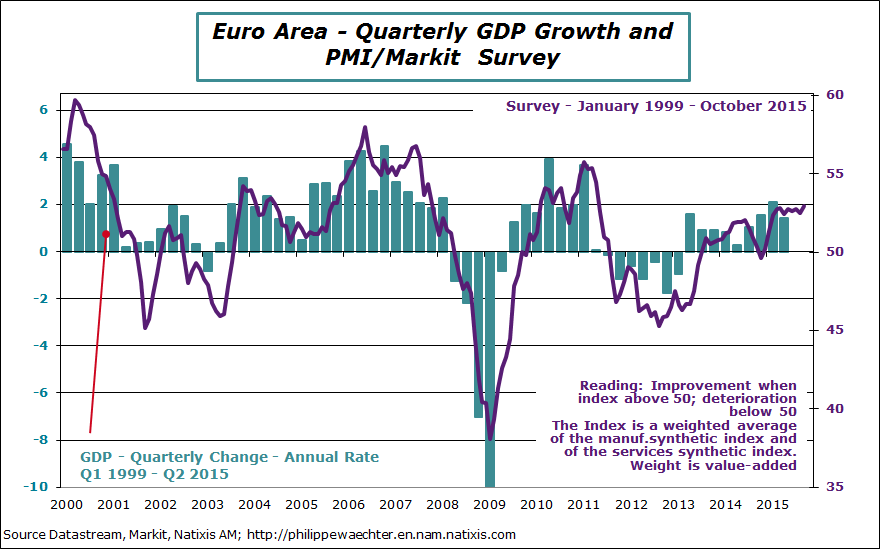

The ECB strategy is consistent with the Fed’s behavior; they both prefer acting a little too late than too early

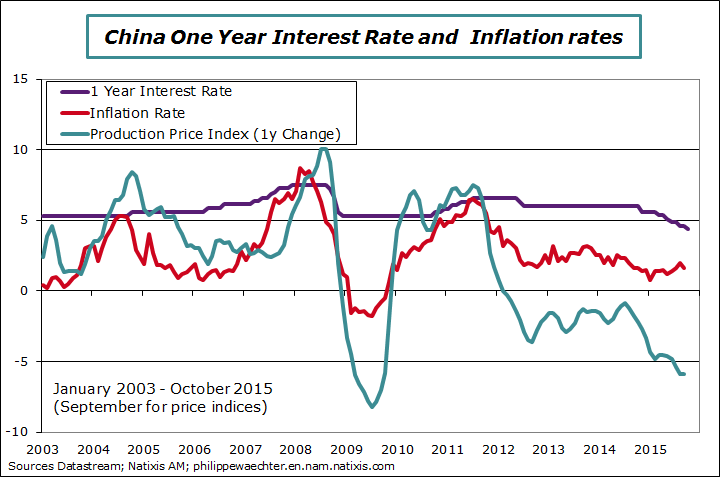

6 – In China the central bank has reduced its interest rates by 25 bp at 4.35% for the one year lending rate and to 1.5% fort the one year deposit rate. The Reserve Requirement Rate was also down by 50bp at 17%.

China is reducing the constraints on growth whereas the economic activity falters. Nevertheless, China is in a huge adjustment process from an industrial led growth economy to a service led growth economy. This will take time and GDP growth will trend downward as services productivity is lower. So the change in monetary policy can help in the very short-term, specifically on land and real estate sectors.

But a simple calculation shows that real interest rate for companies is close to 10 % (interest rate less producer price change) which is way above the GDP growth trend. There is room for lower rates in a deflationary context.

For the week to come the most important point is the Fed’s meeting on October the 27 and 28. Looking at macroeconomic data there is no reason for the US central Bank to change its strategy. There are no tensions in the US economy that could justify a change in interest rates. I’m not sure that the situation will be different in December. I don’t expect a change in monetary policy this year. No press conference is scheduled

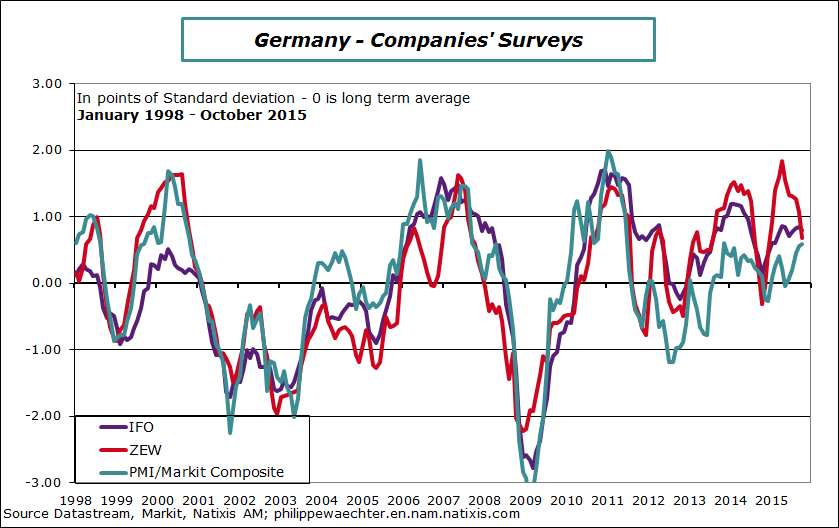

The IFO index has been published on Monday in Germany. It’s a little lower but the German economy is still doing well as it is shown on the graph. The 3 indices are still way above their average. Adjustment on the ZEW reflects correction after an excess.

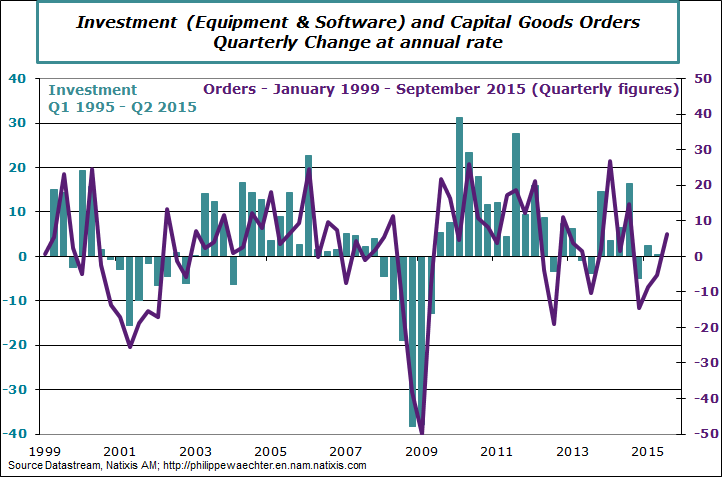

On Wednesday, durable goods orders in the US will give a good preview on corporate investment.

Friday we will have for the Eurozone advanced estimate for the inflation rate in October and the unemployment rate for September. It will also be spending by French households in September.

Have a good week everybody

Philippe Waechter's blog My french blog