Different points to keep in mind from last week

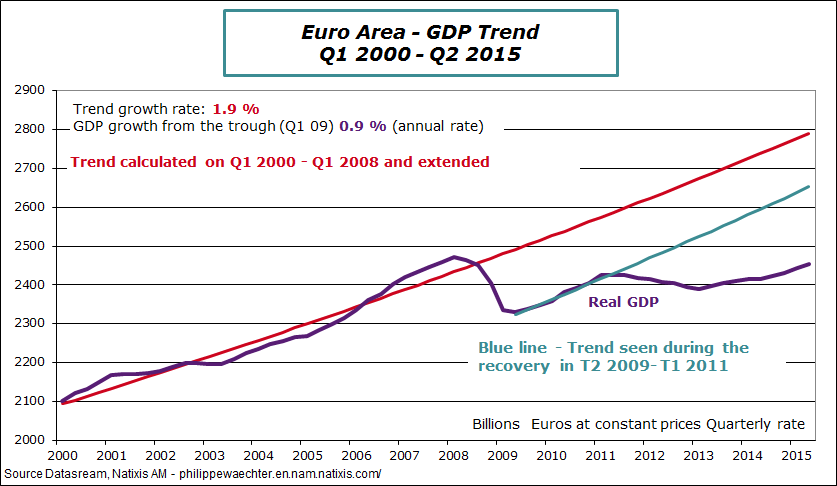

The first point is the upward revision of the Euro Area growth figures for the first and the second quarter of this year. During the first three months, the economic activity was upgraded by 0.1% to 0.5% and during spring GDP figure was inched up by 0.1% to 0.4% (2.1% and 1.5% at annual rate respectively). Carry over growth for 2015 is 1.2% at the end of the second quarter (average growth for 2015 if the GDP level remains at Q2 level for Q3 and Q4)

The growth number for 2015 should be close to 1.5%. It will probably be not hard to converge to this figure; I expect that oil price (Brent) will remain below USD 50. This would be a little higher than ECB’s forecasts at 1.4% published last week.

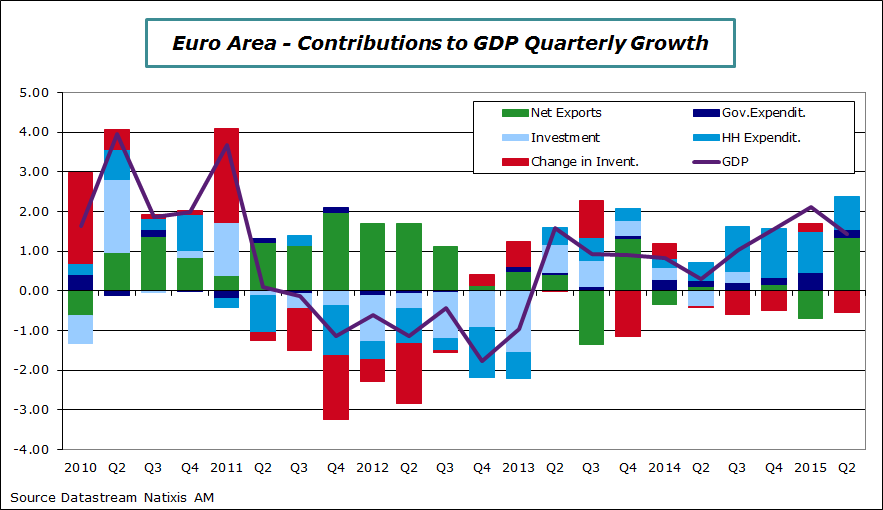

With the second GDP estimate, we can calculate contributions to quarterly growth. If GDP growth figures were close during the two quarters, the composition was radically different between the two. During the first three months of the year, internal demand was the main support for expansion while external demand had a negative contribution. During spring, net external demand has had a strong positive contribution while internal demand was weaker.

During the second quarter, internal demand contribution was down to 0.6% from 2.6% during the first three months of the year (annual rate). Investment decreased during spring and its contribution was negative. At the same time, government expenditures had a positive but slightly lower contribution to GDP quarterly growth. Households’ consumption had also a marginally lower contribution at 0.8% versus 1% during the first quarter.

Next exports had a positive contribution due to a rapid increase in exports which contribution was 1 % higher. Inventories have decreased during the second quarter.

The main point for the Euro Area business cycle is the lack of strong momentum for investment. As far as investment remains choppy, the GDP will remain on a weak dynamics.

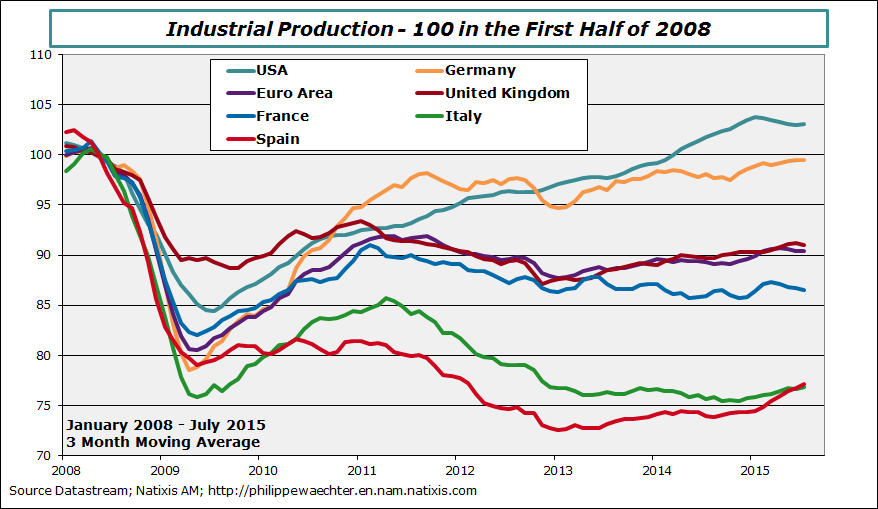

In Spain the index is increasing at a rapid pace (+0.6% in July after 0.4% in June), the rebound in Italy was spectacular at +1% after -1% in June and Germany’s index was up by +0.5% after -0.6% in June. The weakest countries were the United Kingdom with an index that was down for the second consecutive month (-0.4% in June and in July) and France where the index dropped by -0.8% after 0% in June.

The third quarter starts on a strong note in Spain (carry over at 4.6% at annual rate) and in Italy (+2.9%). For Germany, carry over is just +0.4%. In the United Kingdom and France carry over is negative at -2.2% and -2.8% respectively (annual rate).

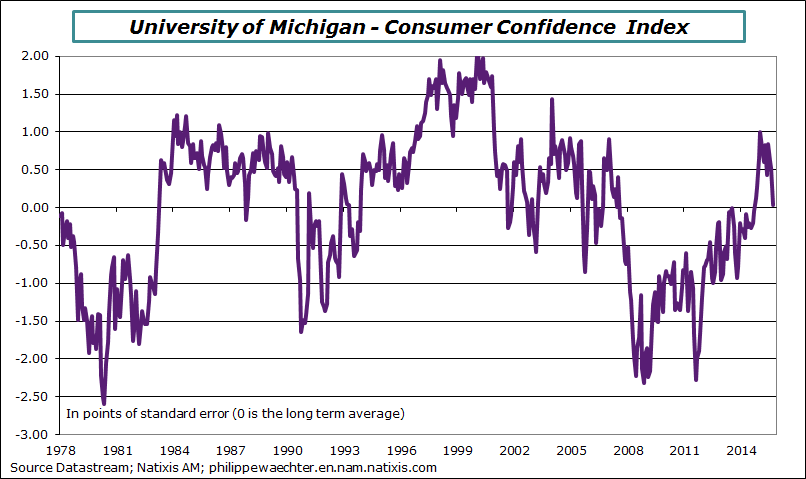

The third point last week is the rapid decrease in the University of Michigan confidence index for September. Households’ confidence dropped to 85.7 versus 91.9 in August. The index is back to September 2014 level. The two components were lower. Current conditions are weaker and expectations for the coming months are lower.

This can be an important move if it is persistent. This index has a profile which is consistent with the 3 month change in real consumption. A permanent drop in the index could then be associated with a lower households’ expenditures momentum. This would have an impact on the business cycle.

Demand momentum is not strong enough to change the picture. Expectations of a rebound are still low even after a more accommodative fiscal policy that was put in place last May.

A reform of State Owned Enterprises (SOE) has been presented on Sunday. It proposes to give a more important role to private investment in the management of these companies. SOE’s productivity and profitability are currently too low and adding incentives with private investment could change the picture in order to improve the efficiency of the global economy. But this will take time and this is not for the current cycle. The target for this reform is 2020.

For the week to come, the most expected event is the Fed’s meeting on Wednesday and Thursday. The issue is the possibility of an interest rate rise. It’s important because Fed’s rate is close to 0% since the end of 2008. What would be important in the case of a lift off is the Fed’s rate expected trajectory. Janet Yellen has already explained that it will be different from what was seen in the past. Usually the Fed increased rate at each meeting. The economy is too weak and the inflation too low to follow the same path. In other words, a rate hike will be followed by another one sometime in 2016. I’m not sure that this could reduce uncertainty. During the press conference, if there is a hike, the main information will be related to this trajectory.

There will be also a lot of inflation figures for August. It will be the case for France and Britain on Tuesday, in the Euro Area, the USA and Japan on Wednesday.

The ZEW survey will be published on Tuesday in Germany. The same day, the industrial production and retail sales for August will be published in the US. On Wednesday employment in UK will be published and data on real estate in the USA (NAHB on Wednesday and housing starts on Thursday)

The French version of this column was published on Monday the 14th (see here)

Philippe Waechter's blog My french blog