Markit Surveys (Flash estimates for December), IFO survey, INSEE Climat des Affaires, the Italian Business Survey, the industrial production in China and in the US, Retail sales in China, Meeting of the Bank of England after the elections, French households’ expenditures

Highlights

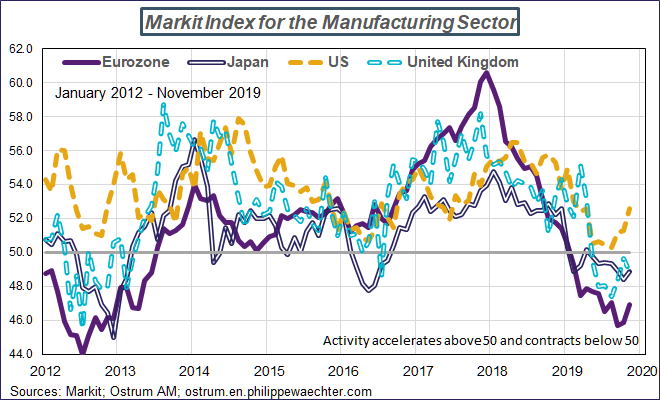

Markit surveys: Flash estimates for December (December 16)

The flash estimates will be available for the US, Japan, the Euro Area, Germany, France and the United Kingdom. These indices usually stabilized in October and November. The Euro index which was the weakest was marginally stronger in November as the German index was up. Nevertheless, the activity is still contracting rapidly in Europe. The only exception in this survey is the US index.

The services indices will probably continue to slow. Composite indices will not rebound.

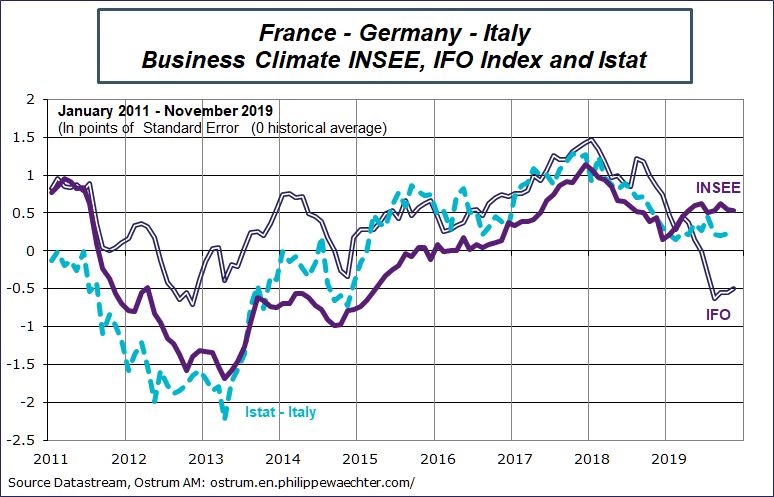

The IFO index in Germany (18), the French Climat des Affaires (19) and the Italian business survey (20) – All these surveys will be for December

The main question is on Germany after the strong rebound seen in the ZEW survey. But keep in mind that the ZEW dropped more deeply before and it is just a catch up.

The other question is on the French survey which will take into account the impact of the public sector strike. Trains cannot circulate and transportation in Paris is not really working. In the long run, the impact of a strike cannot really be seen as there is a rapid catch up when the strike stops but before that the situation can worsen. That’s a risk for the December survey.

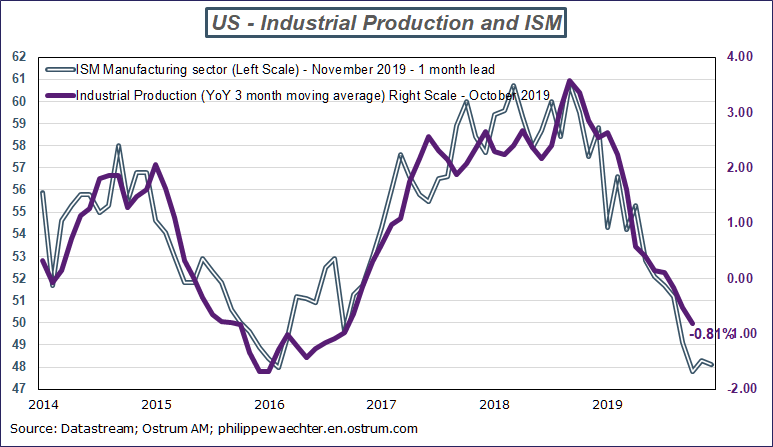

The US industrial production for November (Dec 17)

The US industrial profile follows the ISM manufacturing index trajectory. The ISM was at 48.1 in November. We expect a supplementary slowdown in the US production.

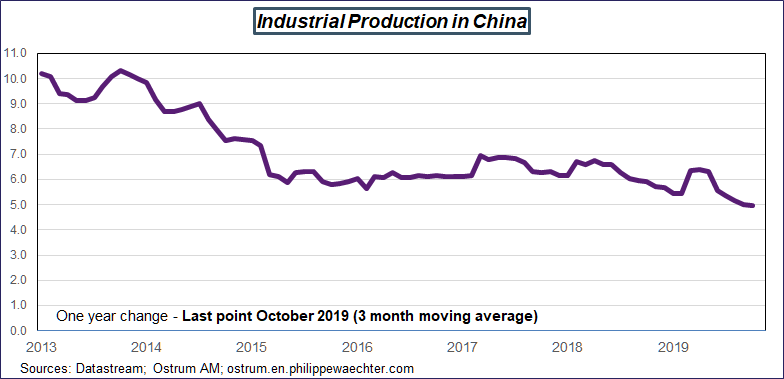

China: The Industrial production, retail sales and investment for November (Dec 16)

The situation remains weak in China. The exports momentum was low in November and this will reflect in the industrial production. We do not expect a rebound in retail sales. Inflation was up in November with the pork crisis limiting the HH purchasing power.

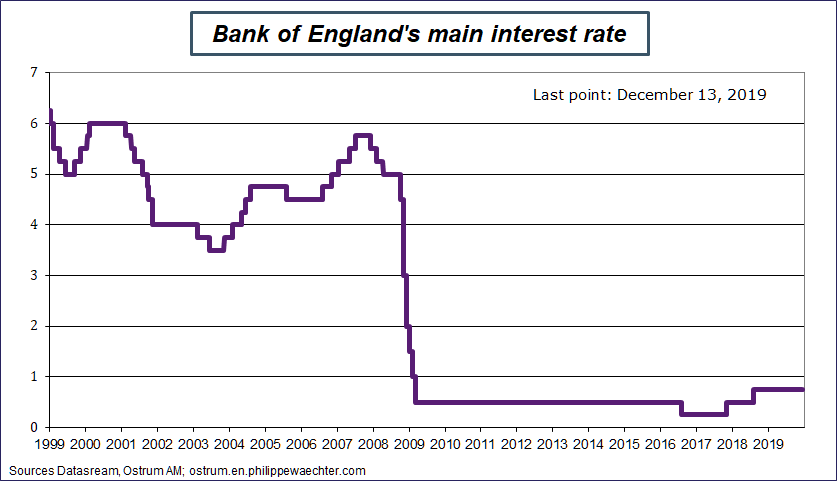

The Bank of England after the general elections result (Dec 19)

What will be the Bank of England position as the Brexit is almost a sure move at the end of next month. The central bank will be a major actor during the transition to the long term regime which will take place after the end of 2020.

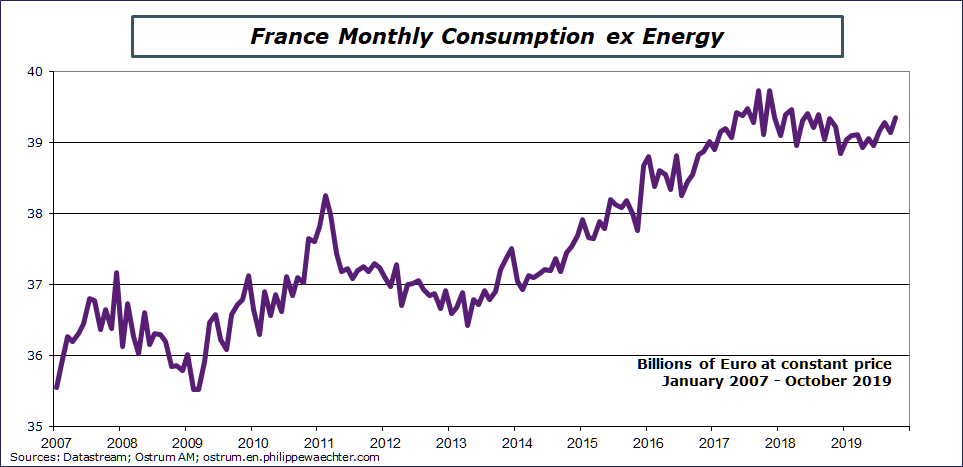

French consumption in goods for November (Dec 20)

Consumption has started a mild rebound in goods since the end of last spring. This is not sufficient as it doesn’t match the rapid and strong improvement of the purchasing power.

Other statistics

National Association of Home Builders (16), US Housing Starts (17) and Existing Home Sales (19)

NY Fed index on the manufacturing sector (16) and PhyliFed (19)

CPI Japan for November (20)

UK: Labour market (17), CBI survey (17), inflation (18) and retail sales (19)

The document is available for download