Markit surveys for September show a slow momentum in the Euro area and in the US.

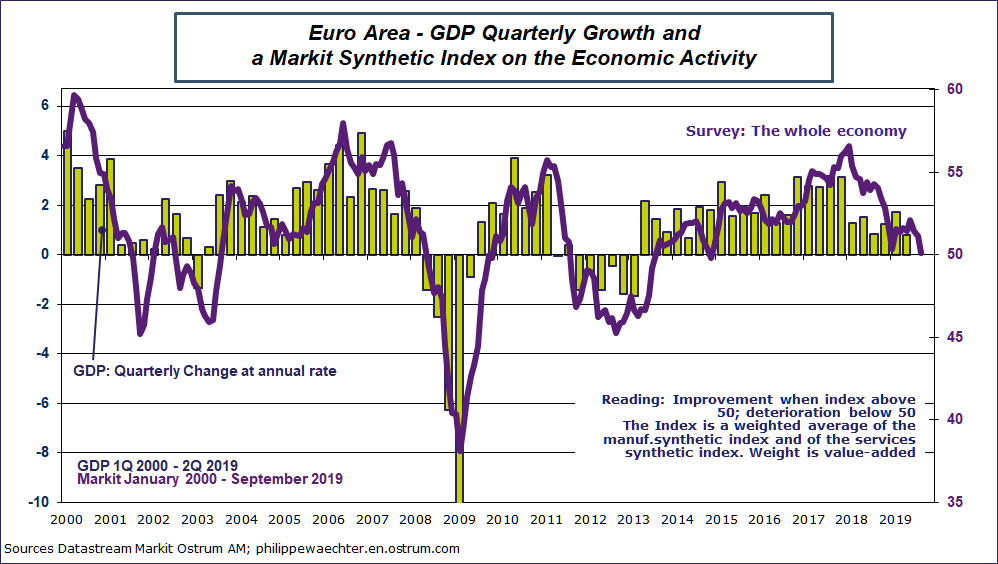

The synthetic index for the Euro Area (weighted average of the manufacturing and non manufacturing synthetic indices) is now close to 50 leading to weaker expectations for the Q3 GDP growth. This reinforces me that GDP growth for 2019 will be circa 1.1%. The impact of the new ECB monetary policy will not lead to an impulse on the upside.

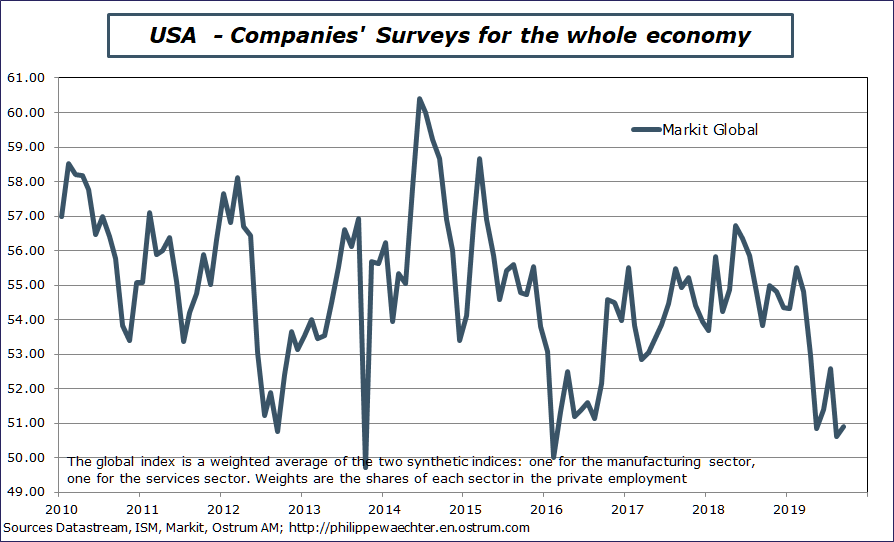

In the US, the synthetic Markit index for the whole economy shows a meager rebound in September despite a stronger manufacturing index. The non manufacturing index has been quite weak in September at 50.9 after 50.7 in August. The services sector doesn’t counterbalance the lack of impulse of the manufacturing sector.The global index is now way below the level seen until last spring and is consistent with a slowdown in the US GDP growth as it was seen in 2016. The more accommodative US monetary policy will not change the picture.

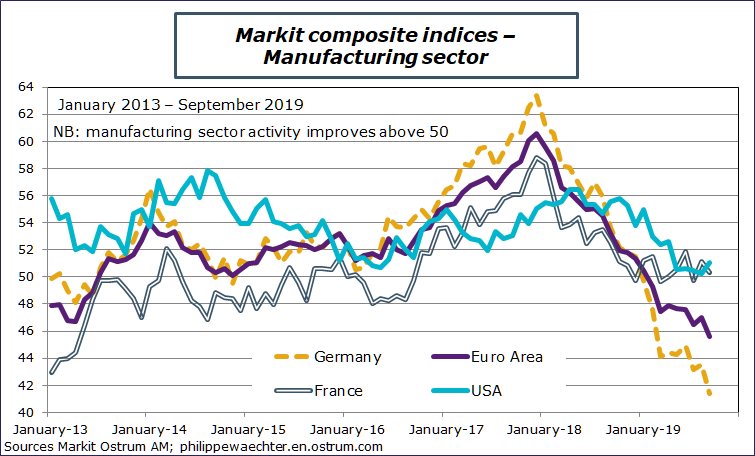

In the short term, the main risk remains in the manufacturing sector. European indices are weak, notably in Germany. This may lead to a recession in this country with a contagion risk to the rest of the euro area. Nevertheless, in the case of a deep recession in Germany, the government would be more active on its fiscal policy, limiting therefore the risk of a recession for the whole zone. This would be the chance for the Eurozone.

Inb September, the US is weak but stabilized. The risk of recession is still low at this moment.